The long-term Price Earnings Ratio (P/E) of the MSCI All-Country World Index. Source: Bloomberg - Dynasty Wealth & Asset Management

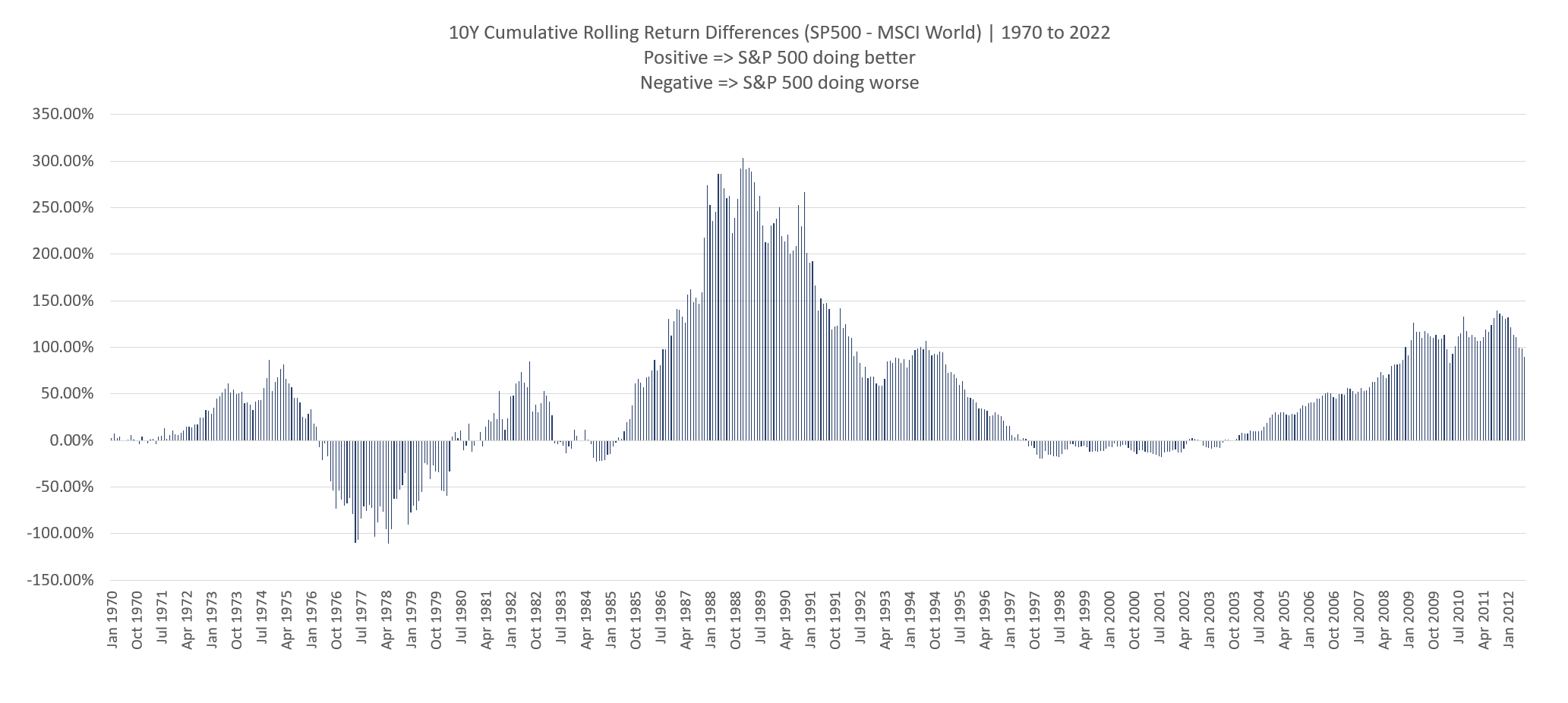

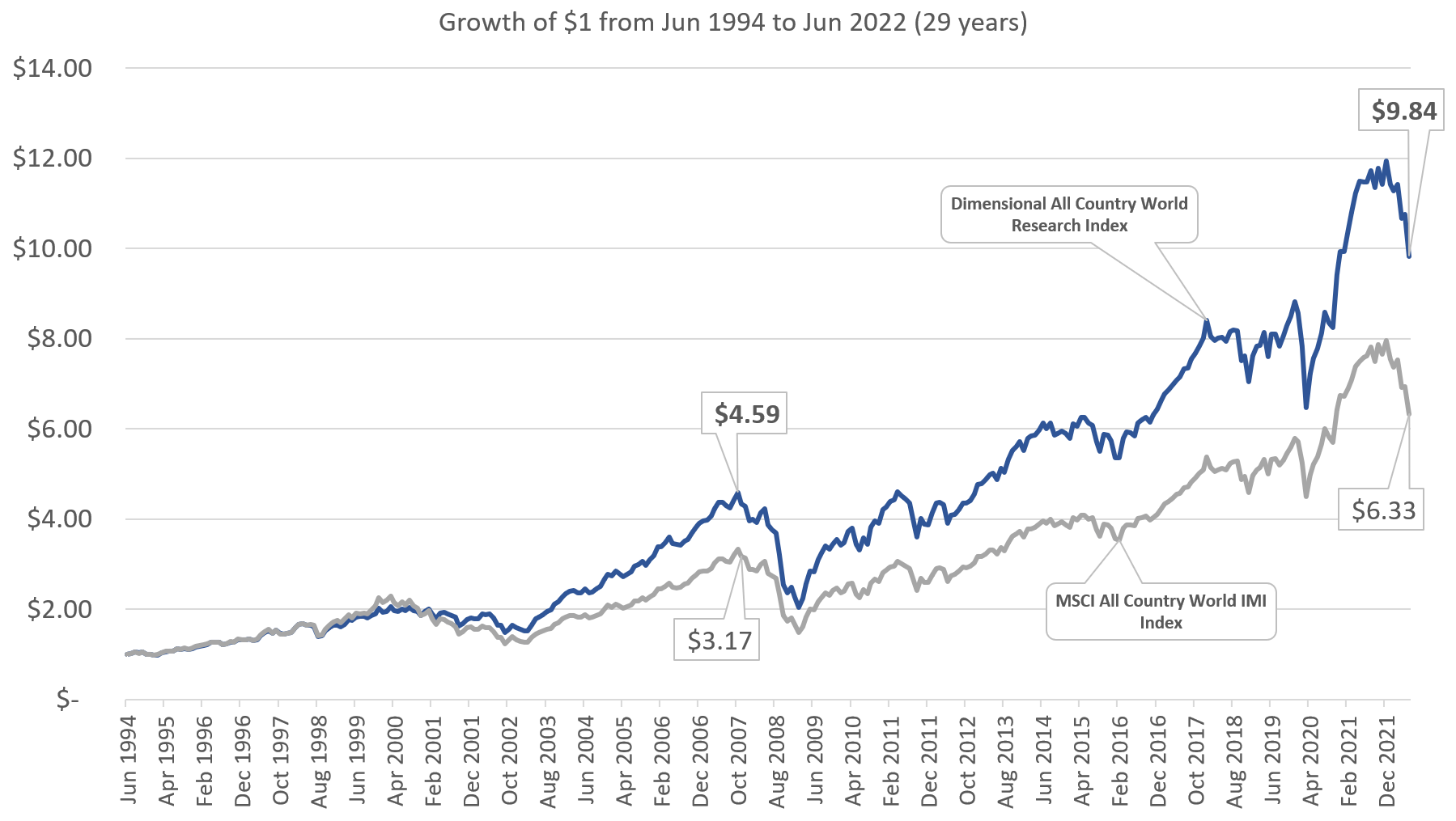

S&P 500 versus the MSCI All Country World Index and the Dimensional All Country World Research Index. | Investment Moats

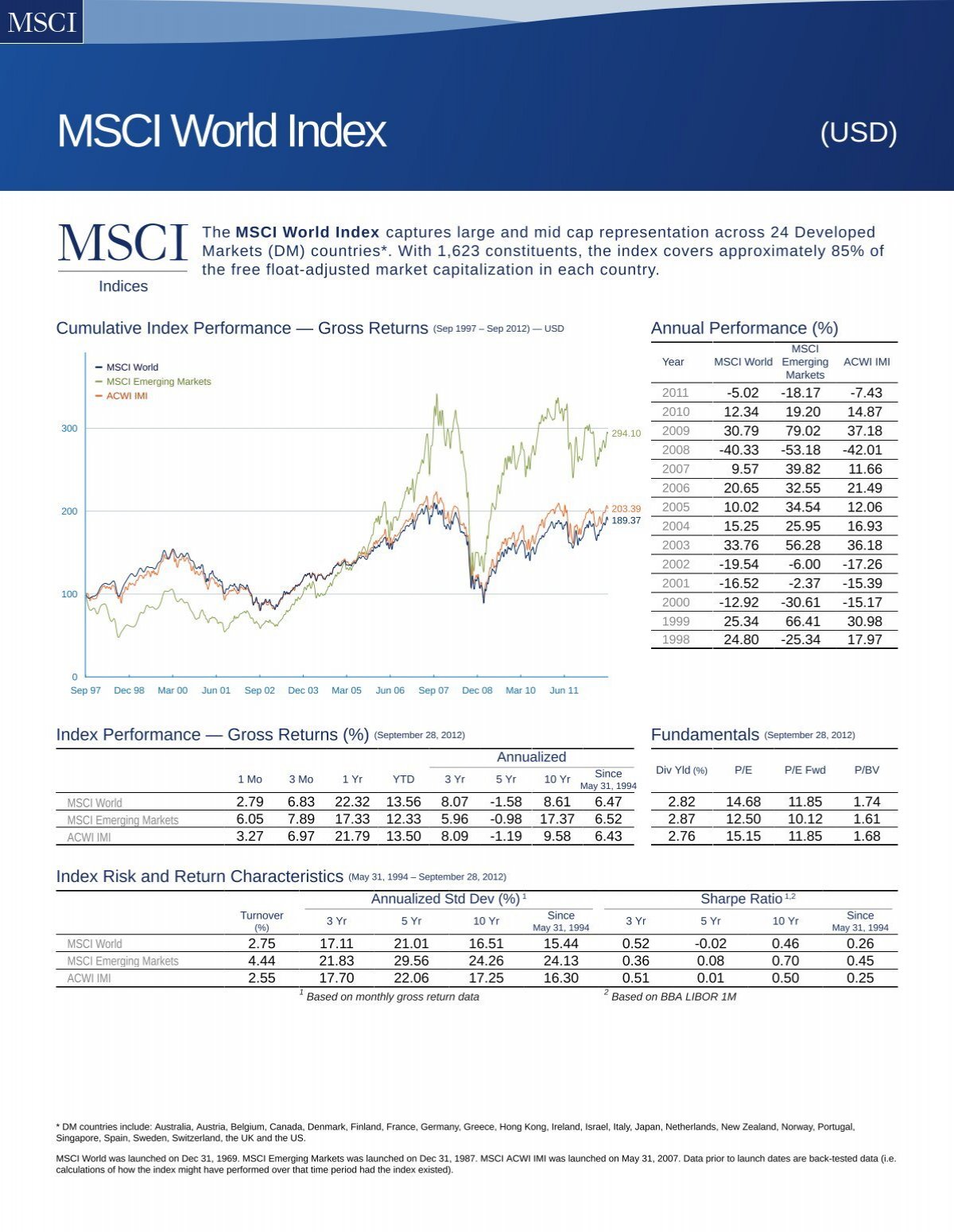

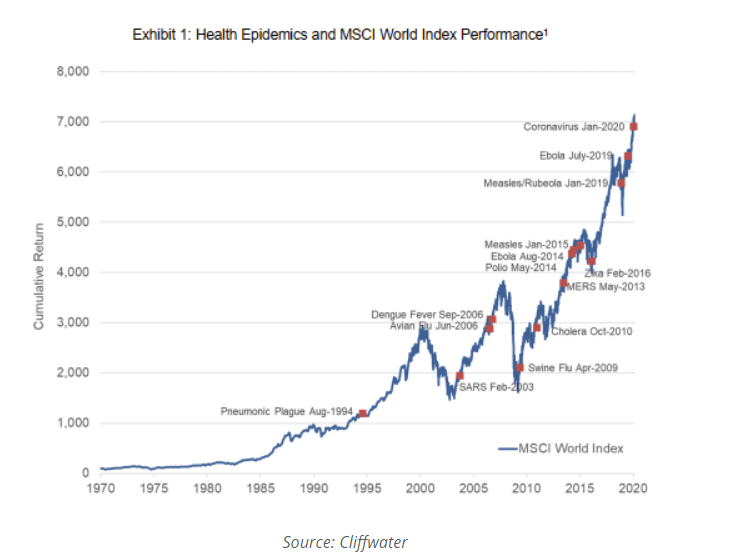

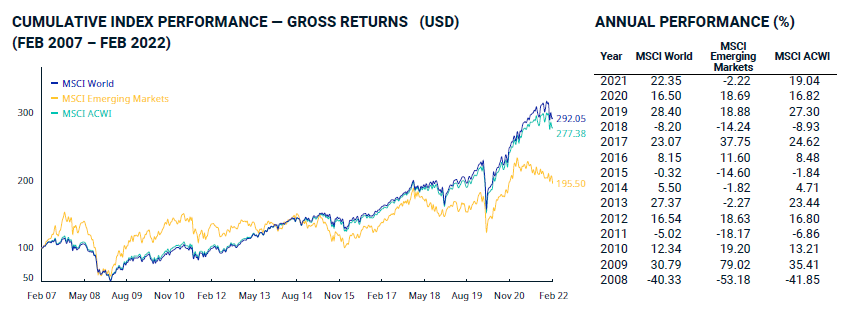

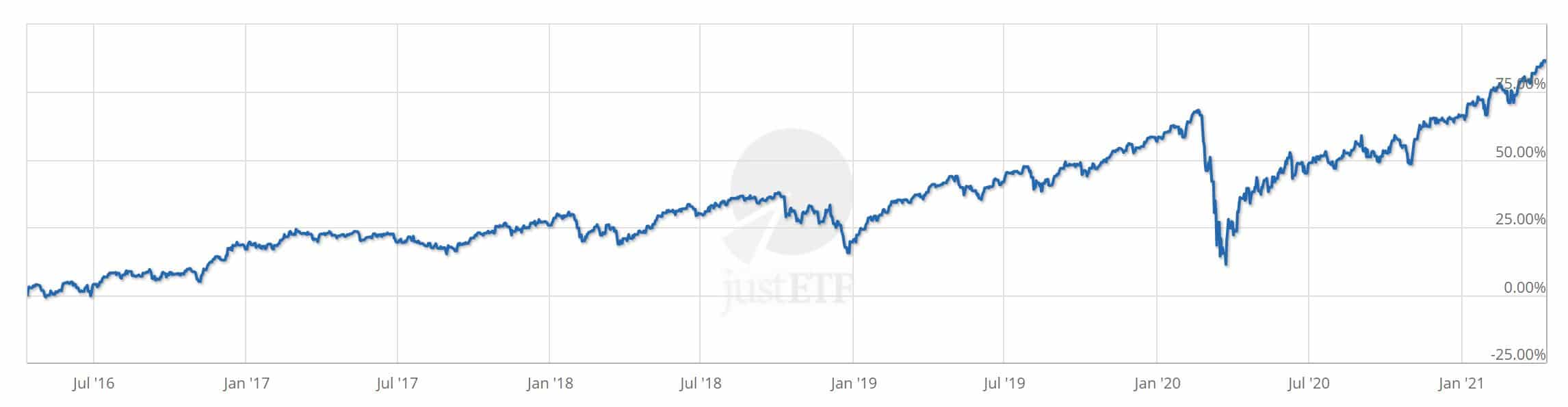

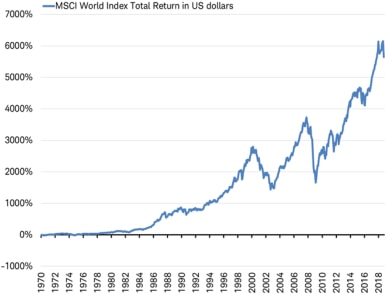

Figure A1: Cumulative Returns of the MSCI World Index. Plotted are the... | Download Scientific Diagram